Discover ways to open a financial savings account on a banking app

[ad_1]

22 Views

The benefit and comfort of on a regular basis banking that cellphones and functions present have modified our lives significantly. The Web has gained a lot credibility, and increasingly more individuals discover it comfy to maneuver their cash round with out having to make use of bodily cheques or money anymore.

Most individuals are banking on-line immediately, and the variety of individuals utilizing the web banking companies is rising. This reveals that the comfort of utilizing a cell bankingapp and the quickness of finishing transactions on-line is attracting individuals. When you’ll be able to pay payments, do purchasing and switch funds utilizing a banking app on-line, how about opening a financial savings account? You are able to do it on-line immediately with out visiting a financial institution.

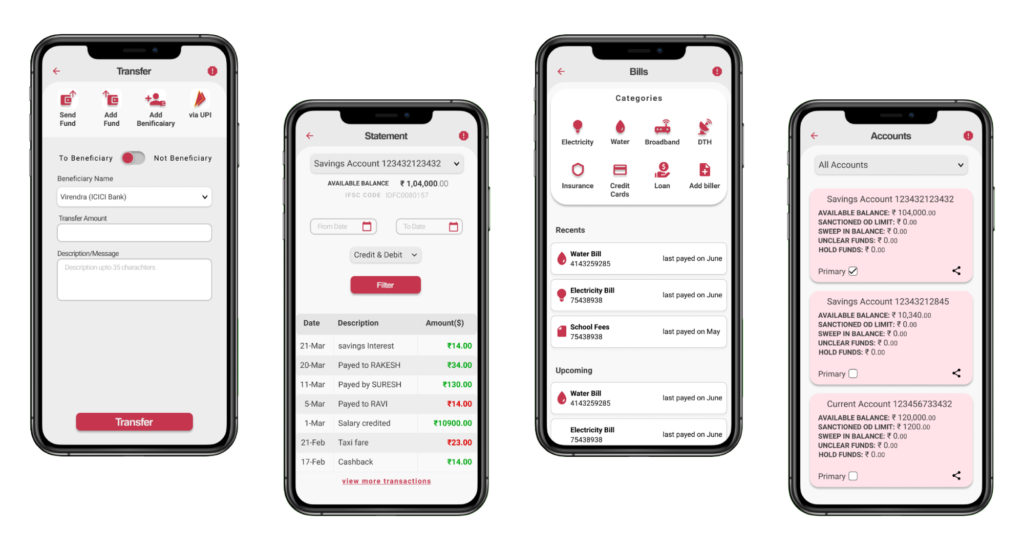

With the IDFC FIRST Financial institution cell banking app, you’ll be able to open a financial savings account on-line immediately.It lets you open any financial savings merchandise like a company wage account, senior citizen financial savings account, minor financial savings or NRI financial savings account in minutes by means of straightforward steps. Earlier than you begin the method, you want the scanned copies of your PAN Card and Aadhaar Card prepared.

Step 1: In case you are but to obtain IDFC FIRST Financial institution cell banking app, you are able to do it by visiting the official web site of your financial institution or from the Google’s Play Retailer or Apple’s App Retailer in your cell. As soon as performed, you’ll be able to create a ‘Username’ by offering the shopper ID, which yow will discover it within the welcome equipment, and account quantity. After that, create a ‘Password’. Now you’ll be able to log into your financial institution’s app utilizing the ‘Username’ and ‘Password’.

Step 2: On loggingin, you’ll have to present your full identify, e-mail tackle and cell quantity.

Step 3: The subsequent step to open a zero steadiness financial savings account is to enter your Everlasting Account Quantity (PAN) and Aadhaar Card or Voter’s ID particulars and add the scanned copies of those paperwork for verification. To authenticate the paperwork, you’ll have to confirm the one-time password (OTP) that you’ll obtain in your registered cell quantity.

Step 4: After that, you’ll have to fill out some private particulars equivalent to your full identify, age, everlasting tackle, occupational standing, annual earnings and some other associated data essential to open an immediate financial savings account. You may full this course of by clicking the ‘Submit’ button.

Step 5: Your utility and supporting paperwork for an immediate financial savings checking account on-line is processed by the financial institution, and you could be known as for KYC verification by means of a video name. You’ll have to maintain the unique Aadhaar Card or Voter’s ID and PAN Card prepared to substantiate the main points supplied on-line. After the verification, your financial savings account is about up and you’ll obtain an e-mail or SMS giving the main points such because the SB Account Quantity, Buyer ID and IFSC Code.

Step 6: You might be required to deposit a minimal amount of cash in your checking account. In the meantime, you even have to substantiate the identify that you just need to give on the debit card.

Your immediate financial savings account will get activated inside just a few hours, for the financial institution will take a while to run backend verification. You can begin utilizing your account instantly after activation by receiving or transferring funds, making invoice funds and recharging your cell or DTH.

With the IDFC FIRST Financial institution’s bestmobile banking app, you can’t solely open an immediate financial savings account but in addition switch cash, pay bank card and utility payments, do purchasing and open mounted and recurring deposit accounts.Apart from offering these wonderful companies, the banking app additionally protects your extremely delicate private particulars by means of encryption.

[ad_2]